8 Reasons for Why to use DSCR loan option in Maryland?

Researched article containing best 8 Reasons for Why to use DSCR loan option in Maryland?

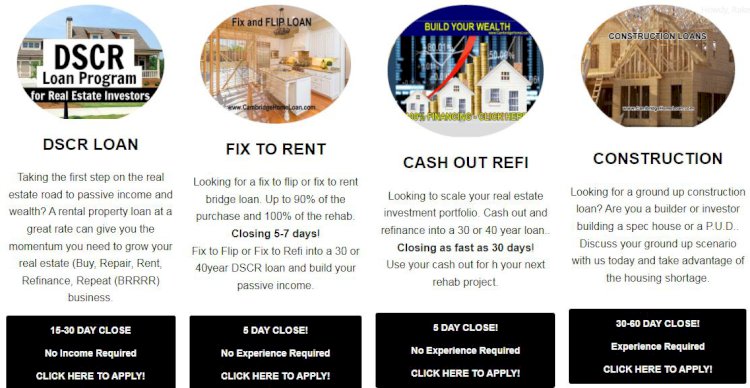

Utilizing a Debt Service Coverage Ratio (DSCR) loan option in Maryland can be a strategic choice for real estate investors for several compelling reasons:

-

Cash Flow Emphasis:

- DSCR loans prioritize the property's ability to generate sufficient income to cover debt payments. This means that lenders assess the property's cash flow potential rather than relying heavily on the borrower's personal financial situation.

- In Maryland's competitive real estate market, particularly in cities like Baltimore and surrounding areas, DSCR loans allow investors to acquire income-generating properties that can provide consistent cash flow.

-

Leveraged Buying Power:

- DSCR loans enable investors to leverage the property's income potential to secure larger loan amounts. This can significantly increase an investor's buying power, allowing them to acquire multiple properties or larger assets.

- Investors can take advantage of favorable market conditions in Maryland and seize opportunities that may not have been feasible with traditional financing.

-

Risk Mitigation:

- DSCR loans assess the property's ability to cover debt payments, reducing the risk of financial stress or default. This risk mitigation strategy helps investors protect their investment portfolio.

- By focusing on properties with strong income-generating potential, investors can create a more resilient and stable portfolio, even in the face of economic fluctuations.

-

Portfolio Expansion:

- Maryland offers a diverse range of real estate investment opportunities, from residential properties to commercial ventures. DSCR loans allow investors to diversify their portfolios by financing various property types and locations within the state.

- Portfolio diversification can enhance overall risk management and potentially boost long-term returns.

-

Long-Term Investment Strategy:

- DSCR loans often come with longer loan terms, aligning with the typical investment horizon for real estate. Investors can secure financing that matches their intended holding period for the property.

- This long-term approach is well-suited for building a substantial real estate portfolio over time and maximizing the property's appreciation potential.

-

Tax Advantages:

- Maryland's tax-friendly environment, including its favorable property tax rates, can enhance the financial benefits of real estate investments. DSCR loans help investors leverage these tax advantages to maximize returns.

- Investors may also benefit from potential tax deductions related to property expenses and interest payments on their DSCR-financed properties.

-

Market Potential:

- Maryland's real estate market has shown growth and resilience, driven by factors such as population growth, job opportunities, and infrastructure development.

- DSCR loans allow investors to tap into Maryland's market potential by acquiring properties that align with the state's economic growth and future prospects.

-

Professional Guidance:

- Collaborating with experienced lenders and financial advisors who specialize in DSCR loans and understand the nuances of Maryland's real estate market can be invaluable.

- These professionals can help investors identify suitable properties, navigate the loan application process, and optimize their investment strategy.

In conclusion, using a DSCR loan Maryland offers real estate investors a strategic approach to property acquisition, risk management, and long-term portfolio growth. By focusing on the property's income potential and leveraging the state's market opportunities, investors can build a diversified and financially rewarding real estate portfolio in Maryland. However, it's essential for investors to conduct thorough due diligence, work with trusted financial partners, and assess each property's DSCR to make informed investment decisions.