10 Points When to use DSCR Loan Option?

Comprehensive Article about 10 Points When to use DSCR Loan Option?

Debt Service Coverage Ratio (DSCR) loans are a valuable financial tool for various situations, primarily in the realm of real estate investment and property financing. Here are some instances when it's appropriate to use a DSCR loan:

-

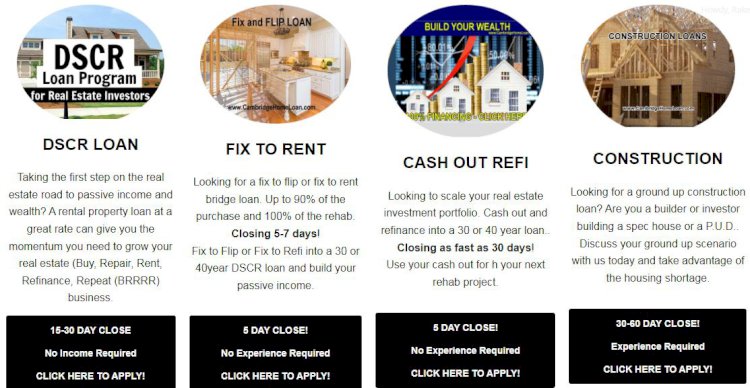

Investing in Income-Generating Properties: DSCR loans are particularly well-suited for investors looking to purchase properties that generate rental income. This includes residential rental properties, multifamily units, commercial real estate, industrial properties, and more. DSCR loans evaluate the property's income potential to determine loan eligibility and terms.

-

Property Acquisition: When you're acquiring a new property and want to secure financing based on the property's income rather than relying solely on your personal credit or income, a DSCR loan can be a valuable option. It allows you to leverage the property's income potential to qualify for the loan.

-

Portfolio Expansion: If you're an experienced real estate investor looking to grow your investment portfolio, DSCR loans provide the means to do so. By assessing the income potential of your existing and potential properties, you can secure financing for multiple properties, thereby expanding your portfolio more rapidly.

-

Refinancing Existing Properties: Real estate investors may use DSCR loans to refinance existing properties in their portfolios. Refinancing can help lower interest rates, extend loan terms, and improve cash flow, enhancing the profitability of an investment.

-

Property Improvement and Renovation: Investors seeking to renovate or improve income-generating properties can use DSCR loans to finance these projects. Whether it's upgrading rental units, renovating a commercial space, or improving property amenities, DSCR loans can provide the necessary funds.

-

Short-Term Investment Projects: DSCR loans are suitable for short-term investment projects, such as fix and flip properties. These loans provide quick access to capital, allowing investors to purchase, renovate, and sell properties for a profit within a short timeframe.

-

Commercial Real Estate Development: Developers engaged in commercial real estate projects, such as building shopping centers, office buildings, or industrial facilities, may use DSCR loans to fund the development phase. These loans assess the projected income from the completed project.

-

Bridge Financing: DSCR loans can serve as bridge financing when you need interim financing to cover gaps between property purchases or project stages. This can be particularly useful in competitive real estate markets.

-

Income Verification Challenges: For investors who have difficulty documenting their personal income but have income-generating properties, DSCR loans offer a solution. They focus on the property's income, reducing the need for extensive income verification.

-

Maximizing Cash Flow: DSCR loans can be used strategically to maximize cash flow from properties by refinancing at lower interest rates or extending loan terms, ensuring that rental income adequately covers debt service payments.

In essence, DSCR loan Maryland is employed in situations where the income potential of a property is a primary consideration for financing, making them a valuable tool for real estate investors, property owners, and developers looking to optimize their investments and grow their portfolios.