Who is the best Bridge Loan Lender in Florida? Call 800-826-5077

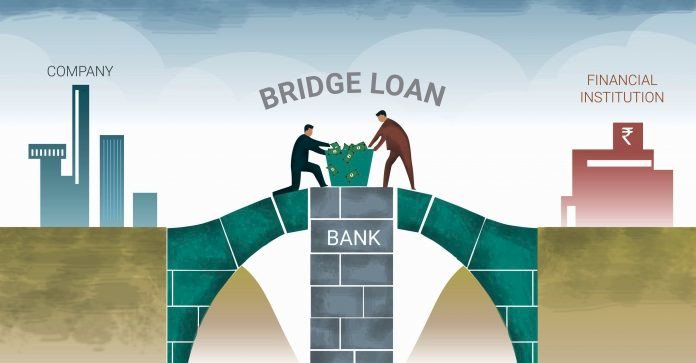

It can be difficult to understand commercial real estate bridge loans in Florida, but it's not. Commercial real estate bridge loans in Florida are available for those who want to buy commercial real property and need to take the time to do some tasks such as improving the property, finding tenants, or selling it.

These Bridge loans typically have terms between six months and one year. Sometimes, the bridge loan lender may allow the owner to extend the loan for up to six months. This extension usually costs between 1/2 and 2 points. This type of loan can also be referred to as a "financing link" between the purchase and development of a property, and the time before a traditional, permanent take-out loan is enacted.

These bridge loans can be helpful in cases where the borrower is looking to buy a commercial property in Florida and has been approved for an SBA loan. The conventional SBA loan is subject to one year of profitable business. The seller will pay back 30% of the property's purchase price to the borrower to get the money needed to finance the project. For the remainder of the loan, the borrower secures a commercial realty bridge loan in Florida. The bridge loan allows the borrower to purchase the property and create a solid operating history that is eligible for long-term conventional financing.

Commercial bridge loans in Florida can be more expensive than permanent commercial loans. This is because commercial realty bridge loans are not designed for long-term financing. These loans are typically paid off when the property owner receives permanent financing. After new tenants have moved in, or after improvements have been made to the property, these loans are usually paid off. Prepayment penalties are not usually associated with these loans.