Student loan payments resume for 2.7 million Floridians

Student loan payments resume for 2.7 million Floridians- All the news about Student Loan.

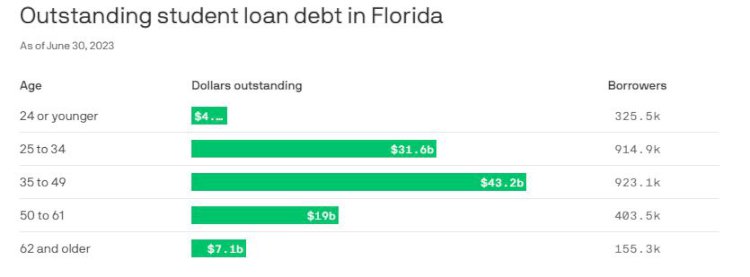

Floridians owe about $105 billion in federal student loans as payments resume in October.

Why it matters: The three-year pause on student loan payments gave borrowers a reprieve during the pandemic. Now, experts warn the return to debt repayment could get messy, Axios' Kelly Tyko writes.

By the numbers: Florida's share of outstanding student loan debt is the third-largest in the nation, trailing only California and Texas, according to the latest U.S. Department of Education data.

The state is home to more than 2.7 million federal student loan borrowers. They owe nearly $38,931 on average, slightly above the national average of $37,300, per the Education Data Initiative.

As of June, people ages 35 to 49 make up the largest group of Florida residents with federal student loan debt, owing a total of about $43 billion.

Catch up fast: In July, President Biden announced that some borrowers who have been paying for decades, including 56,930 in Florida, would have their debt forgiven.

Earlier in October, Biden added $9 billion of student loan forgiveness through "fixes" to debt relief programs, helping 125,000 borrowers across the country.

Be smart: Most people will need to opt in to auto-debit payments before payment restarts.

Use this Axios explainer to figure out your student loan status.

Borrowers can also calculate their repayment with Federal Student Aid's loan simulator.

Between the lines: There's a 12-month "on ramp" for loan repayments, meaning borrowers who miss payments won't be reported to credit bureaus, placed in default, or referred to debt collection agencies.

The on-ramp transition period started on Oct. 1 and runs to Sept. 30 of next year. Borrowers don't have to sign up, according to a White House fact sheet.

Plus: Borrowers can sign up for a new income-driven repayment plan, the SAVE plan, which the White House estimates will save the typical borrower about $1,000 per year.