Fast Closing! Best Hard Money Loan Lender in Oldsmar, Florida

A hard money loan is a loan given to your borrower from a lender based primarily on the worth of the collateralized asset that is underlying. Where asset based lenders aka hard money lenders focus primarily on the value of the asset used as collateral for the loan, traditional banks and lenders focus chiefly on the credit and income of the borrower. Where traditional loans are generally for 15–20 year durations, hard money loans are used as a temporary alternative (1–3 years usually) as a bridge to acquire a rehab, or stabilize a commercial, retail, office, industrial, multi–family, or single family residential home.

CambridgeHomeLoan.com is #1 hard money loan lender in Oldsmar Florida We have gained our reputation as the fastest hard money loan lender in multifamily loans and bridge lending because we know how critical each day is in the competitive Oldsmar Florida real estate market. We are serving all of Oldsmar zip codes including zip codes 33626, 34677, 34685 all of Florida and 47 other US states.

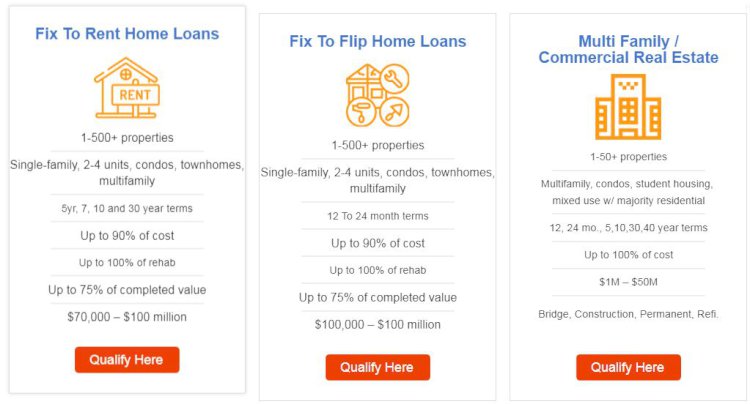

Hard money loan Oldsmar Florida provides a Fast Close for Investment Properties and Commercial Real Estate. Fix and Flip, Fix to Rent, Multifamily, Commercial real estate. We have Purchase, Refinance and Cash out Refinance programs available. Hard money programs can finance up to 90% of the acquisition on fix To flip/Fix to rent and 85% of multifamily acquisition and can provide 100% of the construction costs. For all of your hard money needs contact us today!

Benefits of Hard Money Loan in Oldsmar Florida

Hard Money Loans Are Approved And Funded Quickly

Real estate investors who haven’t previously used hard money will be amazed at how quickly hard money loans are funded compared to banks. Hard money loans can be funded with 3-5 days if needed. Compare that with 30+ days it takes for a bank to fund. This speedy funding has saved numerous real estate investors who have been in escrow only to have their original lender pull out or simply not deliver. This is a perfect situation for a hard money lender to step in, provide financing quickly and save the deal.

Hard Money Loans Have Few Requirements

Banks also have a list of issues that will raise a red flag and prevent them from even considering lending to a borrower such as recent foreclosures, short sales, loan modifications, and bankruptcies. Bad credit is another factor that will prevent a bank from lending to a borrower. Most banks will not lend to a borrower who already has 4 mortgages even if the borrower’s credit is perfect with no other issues.

Hard Money Loans Provide Funding For Projects That Cannot Be Financed Elsewhere

Hard money lenders provide many loans that conventional lenders such as banks have no interest in financing. A good example of this is a fix and flip loan. These projects involve a real estate investor purchasing a property with a short term loan so that the investor can quickly make the needed repairs and updates and then sell the property. In most cases, the real estate investor only needs a 12 month loan. A 12 month term doesn’t work with a bank’s business model. Banks want to lend money for the long term and are happy to make a small amount of interest over a long period of time.